Customer Lifetime Value (CLV) is a powerful metric for performance marketers. It can allow you to see which campaigns, channels, and strategies are the most effective at bringing in valuable customers to your business.

But beyond providing marketing insights, CLV can also be harnessed to reveal crucial product insights. In this lesson, we will discuss how we can do this, and what sort of actionability these insights can give your business

Deriving CLV-based Product Insights

The first step in deriving product insights from CLV is to ask the right questions. Below are a short list of questions that CLV can help us answer about our products:

- What Products are our High-Value Customers Purchasing?

- What Products should we be Marketing the Most?

- What Future Products should we be Developing?

- What Products should we Bundle Together?

- What Products should we use for Up-Selling?

In this lesson, we hope to show you how to use CLV to answer these questions, and what actions you can take once you know these answers.

Why CLV for Product Insights?

A point to make before we dive into details: At first glance, using CLV to judge which products are most valuable to the business seems to be a roundabout way to figure out which product is most expensive. This makes sense, as a customer buying a more expensive item would intuitively be more valuable to the business than a customer buying a less expensive item.

We’ve seen this first hand when working with a larger eCommerce company with a strong digital presence. Their large ticket items purchasers tended to have higher CLVs than those who bought small items, which makes perfect sense (and is an insight that doesn’t need a predicted CLV score to figure out).

But where the real value comes in is the predictive-nature of CLV. Even a high value item could not produce high-value customers in the long term. Many eCommerce platforms find that it is not uncommon for a customer who buys an expensive item to disappear, providing no additional revenue, while a customer who buys a mid-tier item sticks around much longer, resulting in a higher revenue amount over the long term. In this frame, using a CLV-driven analysis would capture this behavior, whereas a revenue-driven analysis would have your team aggressively marketing only your most expensive items at a very high CPA premium.

Product Segmentation

The first strategy to find product insights is segmentation. Many companies have used segmentation for insights before, but for the uninitiated, segmentation is simply grouping customers into similar cohorts based on features you believe are relevant.

To gain CLV-powered product insights, we would use CLV and product purchases to create our segments. K-Means clustering is a common data-driven approach to segmentation.

By doing this, we can easily answer Question #1: What Products Are our High-Value Customers Purchasing?

This question, in conjunction with the number of units sold, is crucial for board reporting, and the answer may surprise you. Very popular products, or products you spend a large amount of your marketing budget promoting, may not be bringing in high CLV customers.

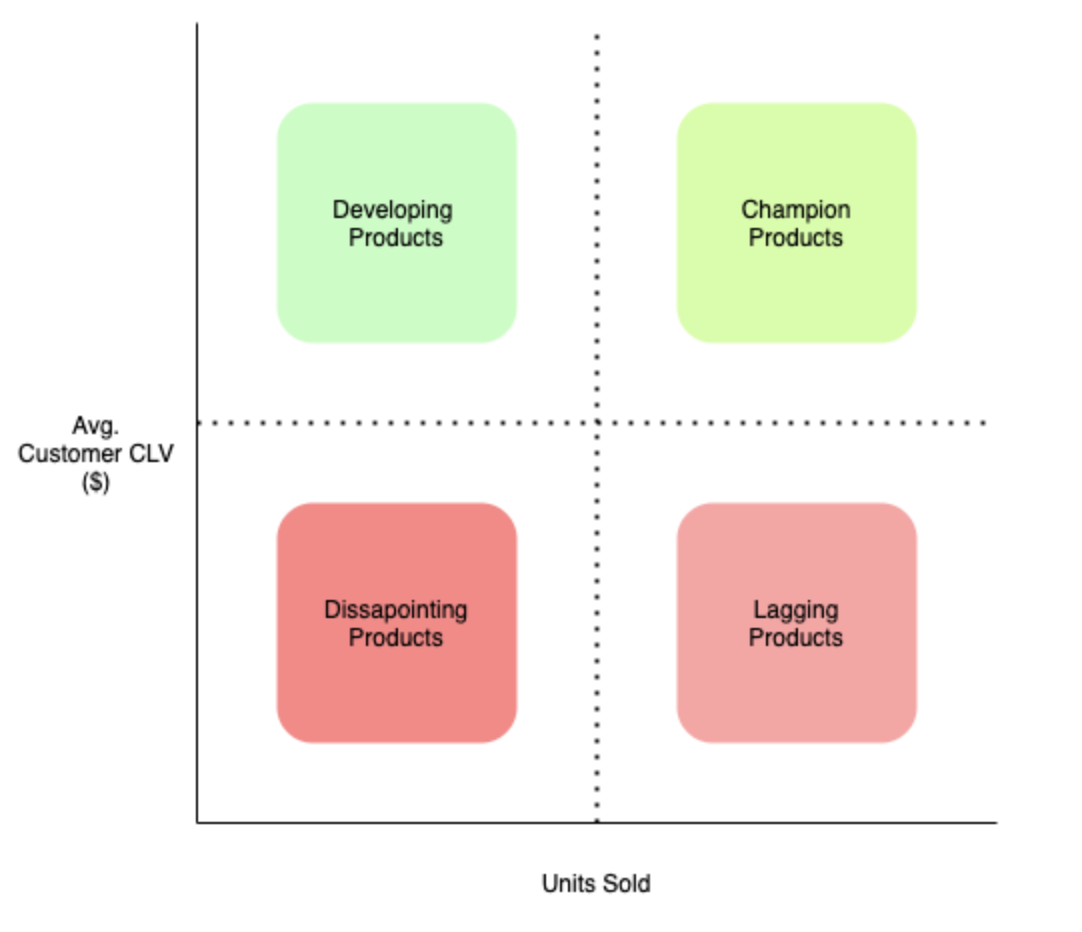

The above graph plots average customer CLV vs units sold. Drawing lines along the averages of both metrics, this chart denotes the four actionable groups that immediately fall out of a product segmentation exercise:

1: Developing Products: High CLV, Low Units Sold

For products with high average CLV and low units sold, understanding the story behind this is crucial. It could be that this is a newer product, and so boosting marketing spend will hopefully drive more unit sales, while keeping the customer CLV high. Another answer is that the product is quite niche, but that niche is a strong segment for your business. Either way, you have an immediate action to take on your developing products.

Developing Products are particularly interesting because they allow for a few compelling actions. As a less common item that produces high-value customers, try bundling this product with a more popular product (such as a Champion or Lagging Product) to see if this converts customers to higher value. We have seen strong returns with this method by offering the developing product for free!

2: Champion Products: High CLV, High Units Sold

For products high in both sales and CLV, you have hit the goldmine! You can obviously boost marketing to push your sales even higher. From the strategy side, you can examine what exactly sets this product above the rest, and use this to create future product offerings that strive to replicate the success of your champion products

Overall, cultivating and maintaining Champion Products should be the primary focus of your marketing budget.

3: Lagging Products: Low CLV, High Units Sold

For products with low CLV but high units sold, product strategy conversations can be rough. It could come as a shock to your team that one of your most popular products is not a Champion Product. Lagging products are dangerous because it is easy to be seduced by raw unit sold numbers and continue to market these products, even though it could be bad for overall customer health. The customer-centric suggestion for lagging products is to reduce the marketing spend for them, and to see if smaller, more targeted efforts can help raise the product CLV.

A potential way to utilize and revive lagging products is to bundle them with champion or developing products. Since the latter are quite popular, you will quickly get your more valuable products into more customers’ hands than if you sold them separately.

4: Disappointing Products: Low CLV, Low Units Sold

For products with low CLV and low units sold the action is simple: Stop selling it! It may be painful to wind-down an offering, but all a disappointing product offering is doing is diverting resources from greener pastures.

Customer lifetime value is a great metric to inform and optimize your product marketing strategy. Once you uncover the spending habits of your high-value customers, you can determine which products you should be marketing, developing, bundling, and upselling.

Back to Courses

Back to Courses